defer capital gains tax uk

Once you have disposed of the buy-to-let property then you are liable to pay capital gains tax. You might be able to minimise your CGT liability by using losses to reduce your gain.

Multifamily Investors Here S Why Cost Segregation Is Your Friend Capital Gains Tax Property Investor Real Estate Investing

Increase the deferred tax liability by 05M.

. There are various capital gains tax reliefs which an individual can utilise to defer the capital gain on a property disposal until a later time thereby postponing the tax bill. See the Introduction to capital gains tax guidance note. Deferring the property gain individuals.

If you made a 2 million dollar profit over one-fifth of that would be paid out to the IRS because of capital gains taxes. The 1012 Tax Bracket. Deferral of exit charge payments for Capital Gains Tax.

You subscribe 150000 for EIS shares issued by a trading company on 1 June 2009. Depending on the nature of the asset disposed of this can result in the individual paying capital gains tax CGT at 20 or 28 in tax years where their taxable income and gains. The latter rate applies where the individual is subject to income tax at the higher rate of income tax.

There is also 30 Income Tax relief on the investment. Capital gains refers to the overall profit you made on your asset. To avoid a CGT charge on an otherwise taxable disposal requires an absence from.

Antiques by individuals at two rates namely 18 andor 28. Some countries such as Spain have a form of deferral relief where a main residence is sold and the proceeds are reinvested in more qualifying property. There is also 30 Income Tax relief on the investment.

This measure deals with the deferment of payment of Capital Gains Tax by certain UK resident trusts or non-UK resident individuals who trade. Capital gains tax EIS deferral relief. This is a very commonly asked question and one which is often misunderstood by many people.

You receive the maximum Income Tax relief of 30000. The annual exempt amount for the 2020-21 tax year is 12300. CGT is normally charged at a simple flat rate of 20 and this applies to most chargeable gains made by individuals.

There are only two exceptions to this. 2 Make use of losses. Tax relief for reinvestment of gains in qualifying schemes is intended to stimulate investment in small businesses and is incorporated into the enterprise investment scheme EIS as EIS deferral relief.

To work out how much of the gain would be tax free you take the number of months you used the property as your home or 18 if greater and divide this by the number of months you owned the. Under the Tax Cuts Jobs Act which took effect in 2018 eligibility for the. This is regardless of whether you have re-invested the profits or spent the money.

Note however that you are required to report the disposal to HMRC within 60 days or within 30 days for disposals which completed before 27. However theyll pay 15 percent on capital gains if their income is 40401 to 445850. You can defer payment of CGT by re-investing the capital gain into an Enterprise Investment Scheme EIS.

These are discussed below. For people in the 10 or 12 income tax bracket the long-term capital gains rate is 0. The good news is there remain ways to reduce capital taxes or even to eliminate them altogether.

There is a lower rate of 6150 for most trustees. Capital gains tax CGT is levied on capital gains made on disposals including gifts of most assets eg. Income tax relief 30 30000 Capital Gains Deferral CGT 20 20000 Net Cost to.

Antiques by individuals at two rates namely 18 andor 28. The revaluation gain is 2M which will be recorded as other comprehensive income OCI so the deferred tax liability on this gain 2M x 20 04M is also recorded under OCI. Q If I sell a buy-to-let property and immediately use proceeds to buy another is the payment of capital gains tax deferred.

If the gain is re-invested into a Seed EIS in the same tax year CGT relief of 50 is given. Gains and losses realised in the same tax year must be offset against each other which can reduce the amount of gain that is subject to tax. Firstly its important to note that there is no general provision allowing CGT on a residential property to be avoided by simply reinvesting the proceeds.

Deferral relief allows a UK resident investor to defer capital gains tax. 1 Use your CGT exemption. If you are non-resident and you are liable to CGT on a disposal of UK land or property or from 6 April 2015 to 5 April 2019 UK residential property then you may not need to pay tax on the whole gain.

Deferring Capital Gains Tax on UK property disposals. Investing a taxable gain in an EIS allows you to defer it for as long as that money remains invested. For example in 2021 individual filers wont pay any capital gains tax if their total taxable income is 40400 or below.

Everyone is allowed to make a certain amount of tax-free capital gains each year. To encourage investment in these areas the IRS has created a program that allows investors to defer a certain amount of their capital gains taxes upon sale. This provides a ready supply of venture capital to growing businesses.

Traditionally you would sell your asset and then have to pay the IRS 20-35 in capital gains tax. In the most advantageous arrangement investors can eliminate 100 of their capital gains taxes as long as they hold the asset for at least 10 years. Above that income level the rate jumps to 20 percent.

The deferred sales trust is a tax deferral strategy that can help owners avoid paying capital gains. Debit deferred tax expense 05M. Here are some ways to potentially reduce your capital gains tax liability.

Credit Deferred tax liability 05M. An individuals net taxable income and chargeable gains for the tax year influence the rate of tax payable on their capital gains. Deferral relief allows a UK resident investor to defer capital gains tax.

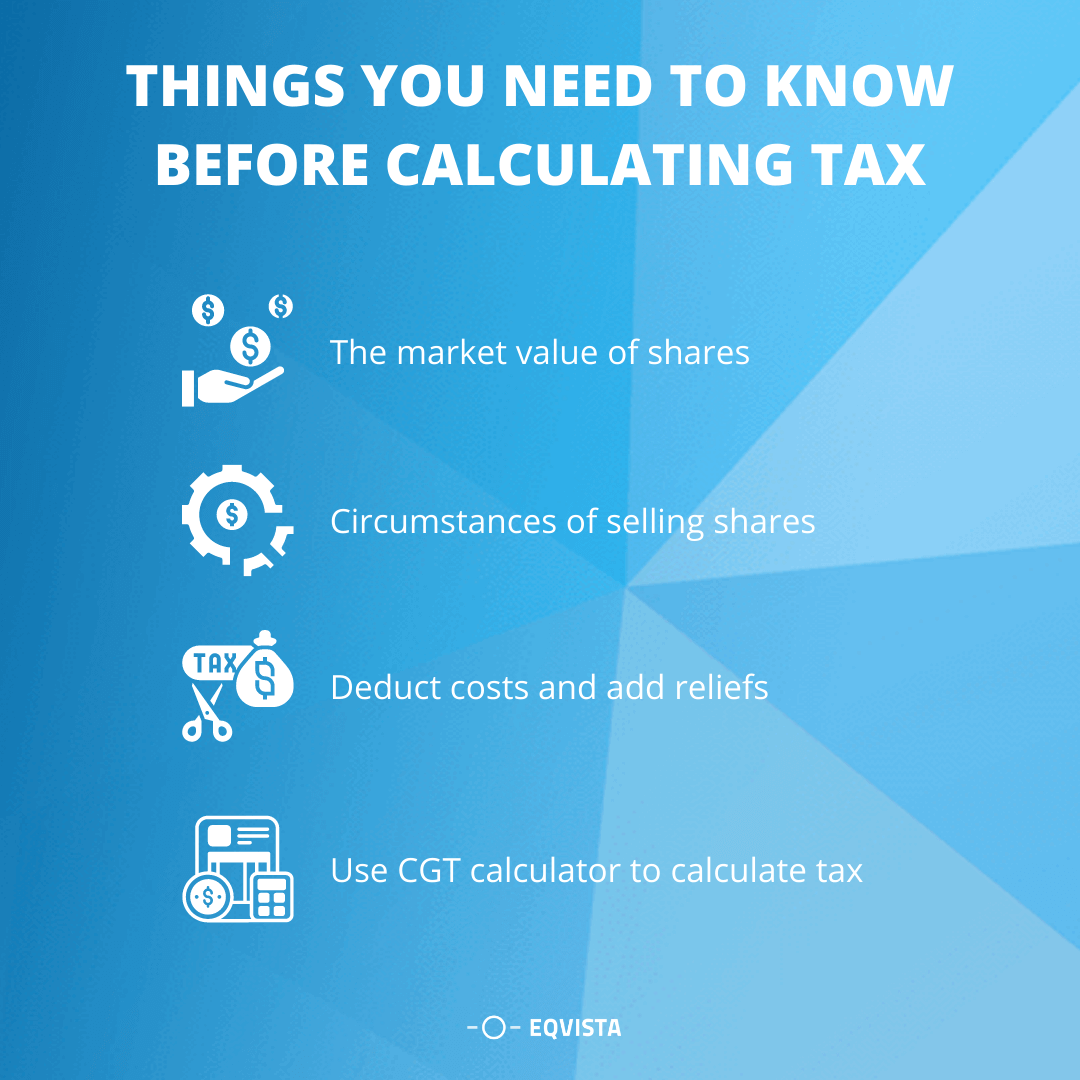

How To Calculate Capital Gain Tax On Shares In The Uk Eqvista

Acronis True Image Home 11 0 8059 Notisbya Roulette Game Casino Roulette

Choose The Correct Verb Forms 1 We Will Have Paid Will Be Paying Back The Loan By December 2 I Merger Financial Management Cost Of Capital

5 Home Trends The Property Brothers Have Ditched And What They Do Instead Today Property Brothers Home Trends Property Brothers At Home

Pin On Blogging Lifestyle Best Of Pinterest Group Board

How To Invest In Real Estate With The Brrrr Method Biggerpockets Real Estate Investing Investing Rehab

Changes In Income Tax Return Forms For The A Y 2015 16 Read Full Info Http Www Accounts4tutorials Com 2015 08 Key C Income Tax Return Income Tax Tax Return

How To Legally Avoid Uk Crypto Taxes Koinly

Not All Vehicles Are Created Equal And For High Earners In Particular The Conventional Wisdom May Not Apply Savings Strategy Financial Planning Hierarchy

Due Dates For Tds Income Tax Return Itr Income Tax Return Tax Return Income Tax

Uk Capital Gains Tax For Expats And Non Residents Expert Expat Advice

How To Calculate Capital Gain Tax On Shares In The Uk Eqvista

We Advise Taxpayers On Tax Efficient Structuring Of Cross Border Investments Including Optimum Use Of Tax Treaties Foreign Tax Investing Tax Credits Secrecy

3 Ways To Defer Capital Gains Tax That Could Turn You A Profit

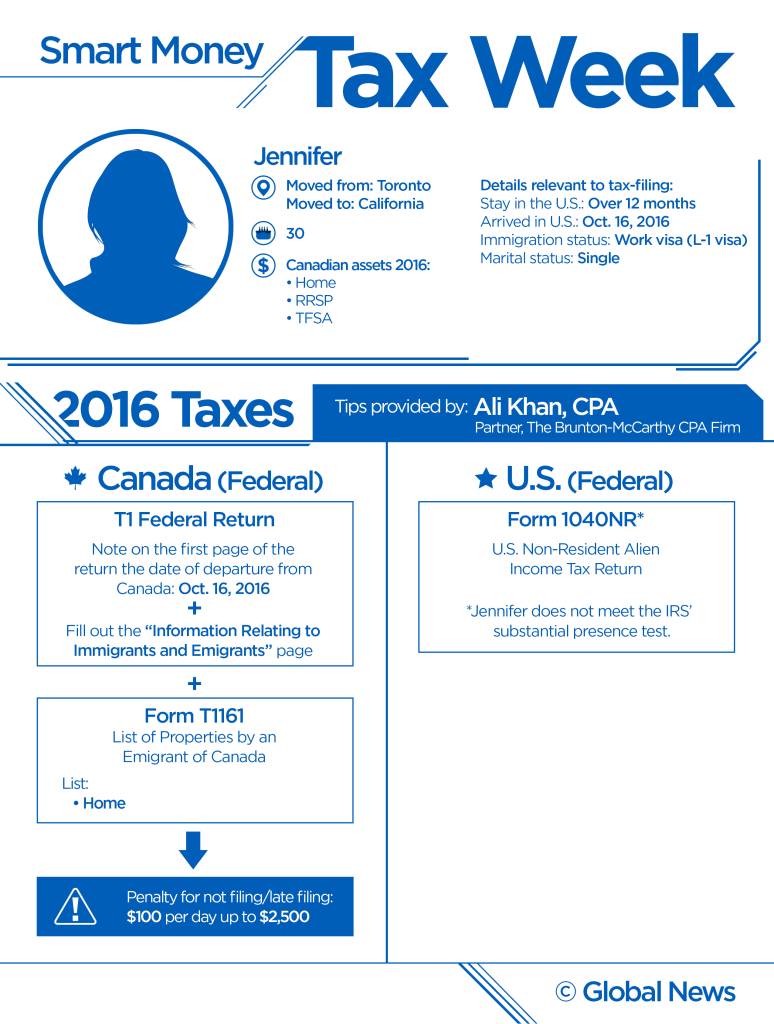

Moving Abroad Mistakes On Your Tax Return Could Wipe Out Your Savings Globalnews Ca

Why To Invest In Elss Investing Money Sense Mutuals Funds

Ifrs Certificate Program Certificate Programs Online Learning Career Growth