wake county nc sales tax rate 2019

Average Sales Tax With Local. Home Jobs GIS Contact Us.

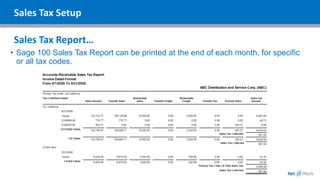

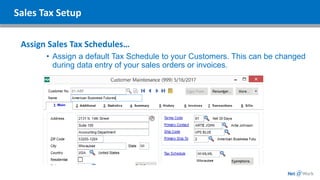

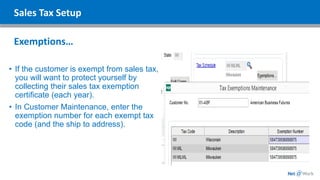

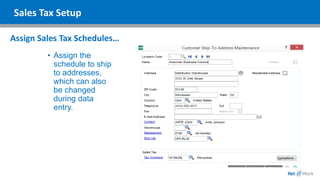

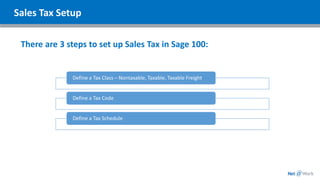

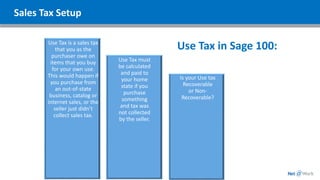

How To Manage Sales Tax Compliance In Sage 100 Manual Or Automated

NC Sales Tax Rate returns to 675 in Wake.

. Search real estate and property tax bills. Walk-ins and appointment information. GET THE LATEST INFORMATION Most Service Centers are now open to the public for walk-in traffic on a limited schedule.

Property value divided by 100. Leave a Reply Cancel reply. The Wake Forest sales tax rate is.

The County sales tax rate is. A single-family home with a value of 200000. Not enough histogram data.

The countys general fund revenue growth adjusted for tax rate changes has trended above US. County rate 60 Raleigh rate 3730 Combined Rate 9730 Recycling Fee 20. Rates include state county and city taxes.

3101 Mail Service Center 1515 NChurch St. Projected AV growth trends as a result of ongoing economic activity and property value appreciation as well as strong sales tax revenue growth. 3 rows The current total local sales tax rate in Wake County NC is 7250.

Some cities and local governments in Wake County collect additional local sales taxes which can be as high as 075. 2020 rates included for use while preparing your income tax deduction. Learn about listing and appraisal methods appeals and tax relief.

The North Carolina sales tax rate is currently. Appointments are recommended and walk-ins are first come first serve. Wake County leaders voted for the measure 6-1 to adopt the 147 billion budget for 2019-2020.

Fitch Rates Wake County NCS 361MM GOs AAA. In other words the property tax bill you receive in July 2019 would represent your property tax burden for the period between July 1 2019 and June 30 2020. The minimum combined 2022 sales tax rate for Wake County North Carolina is 725.

This is the total of state county and city sales tax rates. West Raleigh NC Sales Tax Rate. Town Rate MSD County Fire Rescue Sanitation Community Center Tax Total.

North Carolinas second most populous county will see the new measure take effect on July 1. Did South Dakota v. View 2019 Tax Rates pdf View 2018 Tax Rates pdf View 2017 Tax Rates.

Sales and Use Tax Rates. The Wake County sales tax rate is 2. A Transit Improvement Area sales tax increase affected rates in.

The median property tax in Wake County North Carolina is 1793 per year for a home worth the median value of 222300. Based on 108 income tax records. Dare County NC Home Home Menu.

View statistics parcel data and tax bill files. Wake County has one of the highest median property taxes in the United States and is ranked 571st of the 3143 counties in. Is 36000 - 87500.

The average total salary of Sales And Marketings in Wake County NC is 52500year based on 108 tax returns from TurboTax customers who reported their occupation as sales and marketings in Wake County NC. Hours Monday - Friday. Wilmington NC Sales Tax Rate.

6 rows The Wake County North Carolina sales tax is 725 consisting of 475 North Carolina. Mon 30 Sep 2019 - 441 PM ET. Skip to Main Content.

COUNTY RATE TOWN FIRE DISTRICT RATE INCREASE DECREASE CAR FEE PET FEE DOG FEE. North Carolina Bradford Pear Tree Replacement Event. Sales and Use Tax Rates Effective April 1 2019 NCDOR.

The new Wake County property tax. Plus 20 Recycling fee 196600 estimated annual tax. Wayfair Inc affect North Carolina.

The minimum combined 2022 sales tax rate for Wake Forest North Carolina is. North Carolina has state sales tax of 475. The latest sales tax rates for cities in North Carolina NC state.

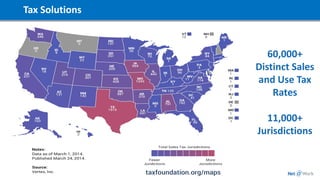

Nearly all of these increases stemmed from ballot measures though local government officials in Wake County North Carolina of which Raleigh is the county seat authorized a rate increase in 2017 as did officials in Albuquerque New Mexico and the District of Columbia in 2018. A Senate sales tax revenue redistribution plan made public this week would cost Durham and Wake counties millions by the summer of 2019 but county commissioners would get a new tool to make up. Total General State Local and Transit Rates County Rates Items Subject Only to the General 475 State Rate Local and Transit Rates do not Apply Items Subject to the 7 Combined General Rate Items Subject to a Miscellaneous Rate Sales and Use Taxes Imposed in Addition to the Rates Listed Above Other Information.

Wake Forest NC Sales Tax Rate. The North Carolina state sales tax rate is currently 475. You must be logged in to post a comment.

On July 1 2011 Announcements Leave a comment. Contact NCDMV Customer Service 919 715-7000. Wake County collects on average 081 of a propertys assessed fair market value as property tax.

View a table of the 2019 tax rates for our county. Pay tax bills online file business listings and gross receipts sales. The property is located in the City of Raleigh but not a Fire or Special District.

This is the total of state and county sales tax rates. NC Sales Tax Rate returns to 675 in Wake County today July 1 2011. 2000 x 9730 194600.

A county-wide sales tax rate of 2 is applicable to localities in Wake County in addition to the 475 North Carolina sales tax.

Taxes Chatham County Economic Development Corporation

Property Taxes By State Embrace Higher Property Taxes

3 21 3 Individual Income Tax Returns Internal Revenue Service

How To Manage Sales Tax Compliance In Sage 100 Manual Or Automated

Property Taxes By State Embrace Higher Property Taxes

3 21 3 Individual Income Tax Returns Internal Revenue Service

Taxes Chatham County Economic Development Corporation

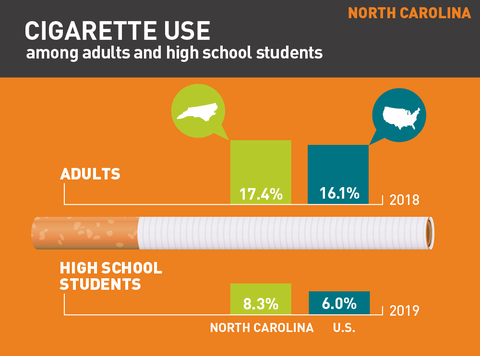

Tobacco Use In North Carolina 2020

How To Manage Sales Tax Compliance In Sage 100 Manual Or Automated

How To Manage Sales Tax Compliance In Sage 100 Manual Or Automated

The Geography Of New Housing Development Nyu Furman Center

How To Manage Sales Tax Compliance In Sage 100 Manual Or Automated

3 21 3 Individual Income Tax Returns Internal Revenue Service

Property Taxes By State Embrace Higher Property Taxes

How To Manage Sales Tax Compliance In Sage 100 Manual Or Automated

How To Manage Sales Tax Compliance In Sage 100 Manual Or Automated

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service